LIENS

Welcome to Synergy’s blog page dedicated to the topic of lien resolution. Our team of subrogation experts share their InSights and knowledge on the latest developments and best practices in lien resolution. Stay up-to-date with the latest trends and strategies to ensure that you have the information you need to navigate the complexities of lien resolution.

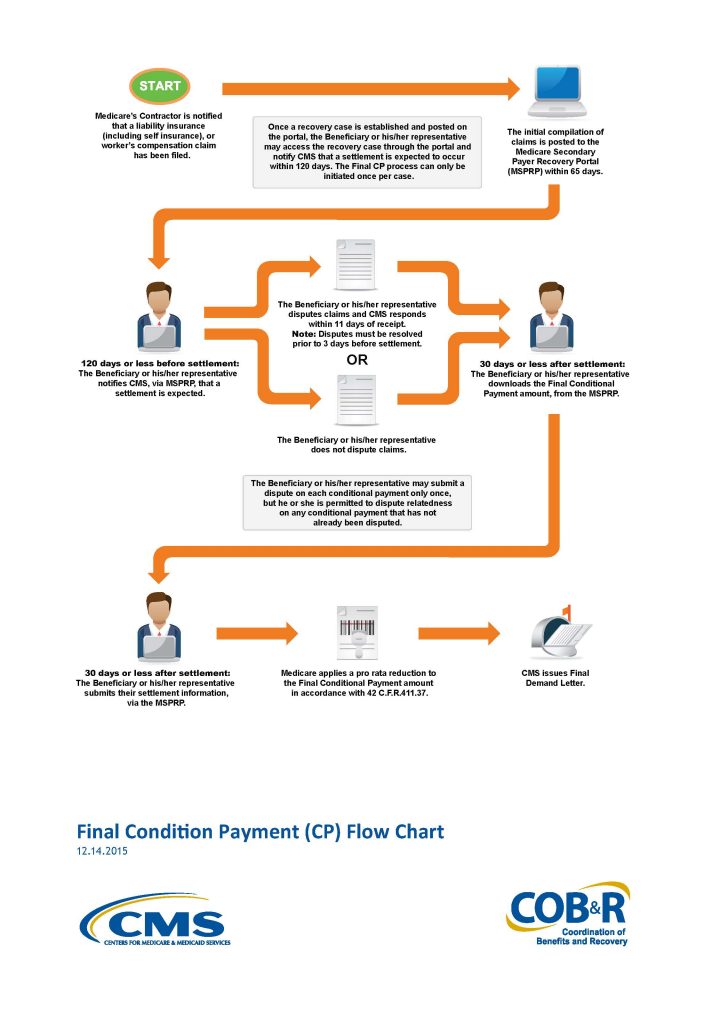

On November 9th 2015 The Centers for Medicare & Medicaid Services (CMS) announced the much anticipated, and long overdue, start date for the new Medicare Secondary Payer Recovery Portal (MSPRP). The new MSPRP will begin functioning on January 1, 2016. The current the MSP Web portal permits authorized users to register through the Web portal in order to access MSP conditional payment amounts electronically and update certain case-specific information online.

CMS is adding functionality to the existing MSP Web portal that will permit users to notify them when the specified case is approaching settlement, download or otherwise obtain time and date stamped Final Conditional Payment Summary forms and amounts before reaching settlement. Additionally, the new MSP Web portal will ensure that relatedness disputes and any other discrepancies are addressed within eleven (11) business days of receipt of dispute documentation.

The process is rather straight forward and will address many of the issues that have plagued the plaintiff’s bar in attempting to settle a personal injury action without any certainty of the repayment amount due Medicare. The process will begin when the beneficiary, their attorney or other representative (SLRS) provides the required notice of pending liability insurance settlement to the appropriate Medicare contractor at least one hundred eighty five (185) days before the anticipated date of settlement.

If the beneficiary, their attorney or other representative (SLRS), believes that claims included in the most up-to-date Conditional Payment Summary form are unrelated to the pending liability insurance “settlement”, they may address discrepancies through a dispute process available through the MSP Web portal. This dispute may be made once and only once. Following the dispute CMS has only eleven (11) business days to resolve the dispute.

After disputes have been fully resolved, and a final claims refresh has been executed on the MSP Web portal, then a time and date stamped Final Conditional Payment Summary may be downloaded through the MSP Web portal. This form will constitute the Final Conditional Payment amount if settlement is reached within 3 days of the date on the Conditional Payment Summary.

The plaintiff attorney will complete the process by providing, within thirty (30) days settlement information to CMS via the MSP Web portal. This information will include, but is not limited to:

the date of “settlement”, the total “settlement” amount, the attorney fee amount or percentage, and additional costs borne by the beneficiary to obtain his or her “settlement”. If this information is not provided within thirty (30) days the Final Conditional Payment amount obtained through the Web portal will expire.

In Humana Medical Plan, Inc. v. Western Heritage Insurance Co., No. 12-20123, 2015 U.S. Dist. LEXIS 31875, the U.S. District Court for the Southern District of Florida granted Humana’s Motion for Summary Judgment and held that Humana’s right to reimbursement for the conditional payments it made on behalf of plan beneficiary under a Medicare Advantage Plan was enforceable and Humana was entitled to double damages pursuant to 42 U.S.C. § 1395y(b)(3)(A). The 11th Circuit will now have the opportunity to decide if this break from precedent is appropriate.

Under the MSP Act’s private cause of action, the Southern District of Florida found that Humana has a right to recover from Western Heritage the benefits it paid and is statutorily entitled to recover double damages. The Court concluded that after Western Heritage became aware of payments by the Humana Medicare Advantage Plan, it had an obligation to independently reimburse Humana. The Court ruled that as a matter of law, Humana is entitled to maintain a private cause of action for double damages pursuant to 42 U.S.C. § 1395y(b)(3)(A) and was therefore, entitled to $38,310.82 in damages.

Western Heritage’s position is that the district court’s holding departed from the plain language of the Social Security Act giving a privately run Medicare Advantage Organizations (“MAOs”) a new cause of action for double damages against primary plans. This holding is contrary to the decisions of several circuit courts and ignores the law’s carefully crafted scheme that permits MAOs to assert (state court) subrogation claims or otherwise bill providers or insurers for health care claims for which MAOs are “secondary,” but does not permit federal court claims, much less for double damages.

Western Heritage arguesthat there is a distinction between Medicare, which has a cause of action for double damages against parties who fail to reimburse conditional payments, and MAOs, who have no such cause of action. This distinction is clearly reflected in the MAO statute, the Medicare Secondary Payer (MSP) Act, the SMART Act amendments to the MSP Act, and the implementing regulations promulgated by the Centers for Medicare and Medicaid Services (“CMS”).

The gist of this position is contained in the following four arguments.

- First, the secondary payor provisions that are specifically applicable to MAOs do not contain any direct cause of action by MAOs against primary payors, let alone an action for double damages. (See, 42 U.S. § 1395w-22(a)(4)). Had Congress intended to grant MAOs a right of action against primary payors, such right would have been included here. However, the right simply does not exist in the MAO statute.

- Second, the provision of the MSP Act that does provide for a private right of action, on which the district court relies, makes no mention at all of MAOs. (Id. 1395y(b)(3)(A)). Again, had Congress intended MAOs to have the right to sue, it could easily have included MAOs expressly in this provision, but did not.

- Third, it is also clear based on the mechanics of the overall MSP statutory and regulatory scheme that neither Congress nor CMS, in its implementation of the MSP Act, intended to grant MAOs a private right of action. Had Congress and CMS intended to bestow such a benefit on MAOs, either would have imposed upon MAOs the same disclosure obligations already imposed on CMS, without which, the MSP payment system does not work. More specifically, CMS administers a program that permits settling parties to ascertain any potential reimbursement obligation following a settlement, judgment, award or other payment in which Medicare beneficiaries are involved. However, no such program exists for MAOs.

- Fourth, under the newly enacted SMART Act amendments to the MSP Act, CMS is required to provide claims and repayment information to primary payors during settlement discussions so that they can account for Medicare reimbursement in their settlements with beneficiaries. In other words, the statute and regulations provide a mechanism to mitigate the possibility that a primary plan will be sued by Medicare for double damages as a result of entering into a settlement with a Medicare beneficiary. However, neither Congress (in the statute) nor CMS (in regulation or guidance), imposed similar requirements on MAOs, or comparable protections for primary payors considering settling beneficiaries’ claims, clearly signaling that they did not intend a right of action in favor of MAOs. With rights come obligations — given that Medicare has the right to sue primary payors for conditional payments, so Medicare has the obligation to inform primary payors of the claims and repayment information at and following settlement. That MAOs have no such obligation further bolsters the conclusion that they have no right to anything more than a subrogation claim.

The district court’s decision permitting a cause of action by MAOs against primary payors, in addition to being incorrect as a matter of law, creates a severe impediment to settlement. As the present case illustrates, primary plans are unable to ascertain whether the party with whom they are negotiating is an MAO plan member and to what extent payment was made to the plan member by the secondary payor, a private MAO. As a result, if the underlying decision stands, primary plans will need to think twice before settling claims and thereby risking a double damages cause of action; even if, like Western Heritage here, they acted in the utmost good faith to learn of any reimbursement obligation. This impediment to settlement runs counter to the longstanding objectives of judicial economy and stands to harm Medicare beneficiaries, primary payors and the Medicare Advantage (“MAO”) plans, whose cases will now be more likely to proceed through trial.

In Humana Medical Plan, Inc. v. Western Heritage Insurance Co., No. 12-20123, 2015 U.S. Dist. LEXIS 31875, the U.S. District Court for the Southern District of Florida granted Humana’s Motion for Summary Judgment and held that Humana’s right to reimbursement for the conditional payments it made on behalf of plan beneficiary under a Medicare Advantage Plan was enforceable. Consequently, Humana was entitled to double damages pursuant to 42 U.S.C. § 1395y(b)(3)(A).

In resolving the underlying personal injury action that gave rise to this case, the plaintiff confirmed there were no outstanding Medicare liens against the settlement proceeds. As evidence the plaintiff presented a letter from The Center for Medicare and Medicaid Services (”CMS”) dated December 3, 2009 which confirmed CMS had no record of processing Medicare claims on behalf of the plaintiff.

Eventually Western Heritage, the third party carrier, learned of Human’s Medicare Advantage lien and attempted to include Humana as a payee on the settlement draft. The state court judge ordered full payment to the plaintiff without including any lien holder on the settlement check. The judge simultaneously ordered plaintiff’s counsel to hold sufficient funds in a trust account to be used to resolve all medical liens.

While Humana and the plaintiff remained in ongoing litigation, Humana filed this action against Western Heritage seeking double damages pursuant to 42 U.S.C. § 1395y(b)(3)(A).

The Medicare Secondary Payer Act (MSP) provides for a private cause of action when a primary plan fails to reimburse a secondary plan for conditional payments it has made.

“there is established a private cause of action for damages (which shall be in an amount double the amount otherwise provided) in the case of a primary plan which fails to provide for primary payment (or appropriate reimbursement) in accordance with paragraphs (1) and (2)(A).”

42 U.S.C. § 1395y(b)(3)(A).

42 C.F.R. §422.108(f) extends the private cause of action to Medicare Advantage Plans (Medicare Advantage Organizations “MAO”s).

“MAOs will exercise the same rights to recover from a primary plan, entity, or individual that the Secretary exercises under the MSP regulations in subparts B through D of part 411 of this chapter.”

Additionally, CMS directors have issued memorandum asserting that:

“notwithstanding recent court decisions, CMS maintains that the existing MSP regulations are legally valid and an integral part of Medicare Part C and D programs.”

CMS, HHS Memorandum: Medicare Secondary Payment Subrogation Rights (Dec. 5, 2011).

While the Eleventh Circuit has not yet addressed the issue of whether a Medicare Advantage Organization, such as Humana, may bring a private cause of action against a primary plan under the secondary provision of the Act, the Third Circuit has addressed the issue and held that it can. In Avandia II the Third Circuit reasoned that the Medicare statute should be read broadly and that the language of the Medicare Advantage Organization statute (42 U.S.C. §1395w-22(a)(4)) cross references the Medicare Secondary Payer Act’s (“MSP”) language (42 U.S.C. § 1395y(b)(2)(A)) which allows these plans to utilize the enforcement provision of the MSP (42 U.S.C. 1395y(b)(3)(A)). The Third Circuit added to their opinion that the MAO plans are able to use the MSP. To deny them this ability, would put them at a competitive disadvantage, and moreover that the federal agency had enacted reasonable regulations in 42 C.F.R. § 422.108. This regulation is relied on by the MAO plans in their recovery actions as it states that the MAO plans have the same recovery rights as traditional Parts A & B

Unlike the Third Circuit the Ninth Circuit in Parra v. Pacificare of Arizona, 2013 U.S. App. LEXIS 7861 was not persuaded that the cross referencing of the MAO Statute (42 U.S.C. §1395w-22(a)(4) ) and the MSP (42 U.S.C. §1395y(b)(2)) created a federal cause of action. The Ninth reasoned that this cross-reference simply explains when MAO coverage is secondary to a primary plan, but does not create a federal cause of action in favor of a MAO. Here the Court found that “[l]anguage in a regulation may invoke private right of action that Congress through statutory text created, but it may not create a right that Congress has not”. They elaborated by stating in clear terms that, “It is relevant laws passed by Congress, and not rules or regulations passed by an administrative agency, that determine whether an implied cause of action exists”.

Western Heritage argues that this Court should follow Parra and “interpret the Medicare Act as not providing a private right of action in favor of MAOs such as Humana.” However, as predicted in my last post on this topic the holding in Parra is too narrow to be of any assistance and the Court here finds the facts of Parra distinguishable. The Court found the Third’s Circuit’s analysis regarding the ability of an MAO to bring a private cause of action under the MSP Act to be persuasive.

Pursuant to the MSP Act’s private cause of action, the Court found that Humana has a right to recover from Western Heritage the benefits it paid and is statutorily entitled to recover double damages. Additionally, “if Medicare is not reimbursed as required by paragraph (h), the primary payer must reimburse Medicare even though it has already reimbursed the beneficiary or other party.” 42 C.F.R. § 411.24(i)(1). Therefore, the Court concludes that after Western Heritage became aware of payments by the Humana Medicare Advantage Plan it had an obligation to independently reimburse Humana. Because it didn’t, the Court rules that as a matter of law, Humana is entitled to maintain a private cause of action for double damages pursuant to 42 U.S.C. § 1395y(b)(3)(A) and is therefore entitled to $38,310.82 in damages.

The trial attorney should now expect the same treatment of Medicare Advantage claims by defense counsel as is now the case with Medicare A & B. Defense counsel will likely demand written confirmation that any purported Medicare Advantage has been satisfied, and may be reluctant to disburse funds to the plaintiff based solely on the expectation that the plaintiff will satisfy this obligation. As a matter of practice it may be more expedient to have defense issue separate settlement drafts to the plaintiff and the MAO rather than a single check with two (2) payees.

Repaying Medicare for conditional payments is a necessary but unpleasant process which can result in a greatly reduced net recovery or no recovery at all for an injured Medicare beneficiary. The Medicare Secondary Payer Statute has a repayment formula that is designed to maximize the return of funds to Medicare and provides no consideration for the future well-being of the Medicare beneficiary. The only consideration that Medicare makes in applying its repayment formula is whether or not the amount of the Medicare Conditional Payments is less than, equal to or greater than the gross settlement. (42 C.F.R. 411.37(c); 42 C.F.R. 411.37(d)). Despite Medicare’s blind application of the repayment regulations, there is a way for the injured Medicare beneficiary to increase his/her net recovery. This is by way of obtaining a refund from Medicare which sounds crazy, but it works.

In the worst case scenario where the amount of Medicare Conditional Payments is equal to or exceeds the gross settlement, the injured Medicare beneficiary experiences the harshest treatment. In that circumstance, the Medicare beneficiary must return all of their net settlement (after attorney fees and costs) to Medicare, resulting in a zero net recovery to the plaintiff. The regulations provide:

“If Medicare payments equal or exceed the judgment or settlement amount, the recovery amount is the total judgment or settlement payment minus the total procurement costs.”

(42 C.F.R. 411.37(d))

This is a situation that is happening with increased frequency as the cost of medical treatment rises and a contracting economy forces many parties to carry only the mandatory minimum limits of insurance coverage. The practical effect of this regulation is seen daily by the attorneys who represent injury victims as they wrestle with the equitable and ethical issues of resolving a policy limits case wherein only the attorneys/Medicare will see any portion of the settlement funds. It may even be the case that the only settlement funds come from the Medicare beneficiary’s own Uninsured Motorist coverage. In that case, the injured plaintiff has been paying premiums for insurance coverage just so Medicare and their attorney can be paid in the event they suffer massive injuries. (See 42 C.F.R. 411.50(b) authorizing repayment to Medicare from UIM proceeds).

In an attempt to reduce the unforgiving nature of the repayment formula, many attorneys have looked for ways to ensure their clients see at least a nominal amount of the personal injury settlement. These client centric attorneys often want to reduce or waive their fees and costs once they have received the “Final Demand” from the MSPRC. Despite the good intentions of these attorneys, if they reduce or eliminate their fees without updating the settlement information provided to MSPRC they are committing Medicare fraud. According to the regulations:

“Recovery against the party that received payment—

(1) General rule. Medicare reduces its recovery to take account of the cost of procuring the judgment or settlement, as provided in this section, if—

(i) Procurement costs are incurred because the claim is disputed; and

(ii) Those costs are borne by the party against which CMS seeks to recover.”

(42 C.F.R. 411.37(a))

If the costs (including attorney fees) are not borne by Medicare beneficiary then under the above regulation Medicare would not have applied the reduction formula to their demand for repayment. Yet informing Medicare that the attorney has waived fees or costs will only result in Medicare increasing its repayment demand in the same amount, still leaving the injured plaintiff with nothing. This leaves the only option of “gifting” all or a portion of the attorney fees back to the client, which involves its own set of tax consequences and potential ethical quandaries.

As an answer to this problem, Synergy has developed a low-cost way for Medicare beneficiaries to take advantage of seldom used statutes/regulations to obtain a refund of all or part of the funds which were paid to MSPRC in satisfaction of Medicare’s “Final Demand.” There are three statutory provisions under which Medicare may accept less than the full amount of its Conditional Payment:

1. §1870(c) of the Social Security Act;

2. §1862(b) of the Social Security Act; and

3. The Federal Claims Collection Act (FCCA).

Each statute contains different criteria upon which decisions to waive or compromise Medicare’s claim are considered. Additionally, the authority to grant a waiver or compromise under each of these statutes is limited to specific entities. Medicare contractors have authority to consider beneficiary requests for waivers under §1870(c) of the Act. Whereas, authority to waive Medicare claims under §1862(b) and to compromise claims under FCCA, is reserved exclusively to the Center for Medicare and Medicaid Services (“CMS”).

MSPRC has the authority to grant full or partial waivers to beneficiaries for whom repayment of Medicare’s Conditional Payments would pose a financial hardship. According to the regulations:

“There shall be no recovery if such recovery would defeat the purposes of this chapter or would be against equity and good conscience.”

(See, 42 U.S.C. § 1395gg (c), §1870(c) of the Social Security Act; 42 C.F.R. 405.355-356; 42 C.F.R. 405.358; 20 C.F.R. 404.506-512; Medicare Secondary Payer Manual (MSP), Chapter 7 § 50.5.4.4).

In order to apply for this “Financial Hardship” waiver, the Medicare beneficiary must file form SSA-632-BK with MSPRC which documents their financial situation. Synergy also includes in this request a letter drafted by the Medicare beneficiary (not their attorney) explaining the undue hardship that repaying Medicare would cause. These decisions by MSPRC are made on a case by case basis. The MSPRC’s manual explains their approach well and provides indicators of whether or not a waiver should be granted.

In addition to a request made to MSPRC for a “Financial Hardship” waiver under §1870(c) of the Social Security Act, Synergy requests a “Best Interest of the Program” waiver direct from CMS under §1870(b) of the Social Security Act. Requests for a waiver under this statute are often overlooked by even the most seasoned attorneys and lien resolution companies. Synergy however understands that the settlement proceeds for which the Medicare beneficiary is fighting to retain is the only source of a recovery for the injuries sustained and must provide for their future needs. Therefore, Synergy vigorously pursues every avenue that can be used to obtain a refund from Medicare. CMS has authority to waive in full or in part Medicare’s claim for repayment when it is “in the best interest of the program.” This rather vague criteria is nowhere further defined and lies completely at the discretion of CMS.

It is important to note that an evaluation by CMS of a “Best Interest of the Program” waiver is a separate and distinct evaluation than a request for a Compromise under the Federal Claims Collection Act (FCCA). As the stakes are high for the Medicare beneficiary, Synergy always makes both a request for this waiver and a request for a compromise when seeking a refund from CMS of the amounts the beneficiary has already paid to satisfy the “Final Demand.”

The third and final method for obtaining a refund from Medicare is a Compromise request made to CMS. Authority to grant a Compromise is granted to CMS under the Federal Claims Collection Act (FCCA). (31 U.S.C. 3711).

The Medicare Secondary Payer Manual compiles the statutory and regulatory sources, articulating the criteria in a straight forward manner as follows:

“[31 U.S.C.3711] gives Federal agencies the authority to compromise where:

- The cost of collection does not justify the enforced collection of the full amount of the claim;

- There is an inability to pay within a reasonable time on the part of the individual against whom the claim is made; or

- The chances of successful litigation are questionable, making it advisable to seek a compromise settlement.”

(Medicare Secondary Payer Manual (MSP), Chapter 7 § 50.7.2)

As one can see, there are many things for CMS to evaluate on a case by case basis to determine if the proposed Compromise should be accepted or not. Synergy has developed detailed processes to insure that each relevant factor is brought to the attention of CMS so that the Medicare beneficiary has the best possible chance for obtaining an acceptance of the offered Compromise.

Obtaining a refund from Medicare of all or part of the funds paid to satisfy the “Final Demand” is not an easy task. It requires intimate knowledge of a variety of statutes, regulations, and the Medicare Secondary Payer Manual. However, it may be the only method by which a severely injured Medicare beneficiary will be able to obtain any portion of their personal injury settlement funds. Synergy has the knowledge and experience to employ all available tactics to obtain a refund for our customers. We also have a successful track record in obtaining substantial refunds for Medicare beneficiaries. We understand the importance of preserving settlement funds for the injured plaintiff and share the client centric mentality of the plaintiff’s bar. To that end, Synergy provides a Medicare Lien Resolution Service at a very low up front cost by taking our fee in proportion to how successful we are in obtaining a refund for the Medicare beneficiary (% of savings).

To see the kind of results Synergy achieves for its clients in terms of lien reduction, click HERE

Applying Collateral Source Statutes to ERISA after Wurtz

The U.S. Court of Appeals for the 2nd Circuit rendered a major decision on July 31, 2014 holding that New York’s anti-subrogation statute is “saved” from ERISA preemption. (Wurtz v. The Rawlings Company, — F.3d—, 2014 WL 3746801). This ruling holds that neither the express preemption found in 29 U.S.C. § 1144(b)(2)(a) nor the complete preemption of 29 U.S.C. § 1132(a)(1)(B) protects the ERISA plan from New York’s anti-subrogation statute (N.Y. Gen. Oblig. Law § 5‐335).

ERISA plans are able to preempt all state laws, except if the law relates to banking, insurance or securities.

“[T]he provisions of this … chapter shall supersede any and all State laws insofar as they may now or hereafter relate to any employee benefit plan…”

29 U.S. Code § 1144 (a)

However,

“[N]othing in this subchapter shall be construed to exempt or relieve any person from any law of any State which regulates insurance, banking, or securities.”

29 U.S. Code § 1144 (b)(2)(a)

The New York anti-subrogation statute in question, § 5-355, specifically stated that:

“[I]t shall be conclusively presumed that the settlement does not include any compensation for the cost of health care services … to the extent those losses … have been … reimbursed by an insurer.” Id.

And

“No person entering into such a settlement shall be subject to a subrogation claim or claim for reimbursement by an insurer and an insurer shall have no lien or right of subrogation or reimbursement” Id.

The 2nd Circuit in New York found that this statute was “saved” under 29 U.S. Code § 1144 (b)(2)(a) as a law that “regulates insurance.” The standard used by the Court in Wurtz was established in the 2003 case Kentucky Ass’n of Health Plans, Inc. v. Miller, 538 U.S. 329. That case established a two prong test.

A law “regulates insurance” under this savings clause if it (1) is “specifically directed toward entities engaged in insurance,” and (2) “substantially affect[s] the risk pooling arrangement between the insurer and the insured.” Id. at 342

In analyzing the first prong of the test the Wurtz court followed the broad rule established in the seminal ERISA case, FMC Corp. v. Holliday, 498 U.S. 52 (1990). In that case the Supreme Court found that the expansive statutory language at issue “[a]ny program, group contract or other arrangement” was more than sufficient to constitute being “specifically directed” at insurance. In fact, the Supreme Court found that even though broad language “does not merely have an impact on the insurance industry, it is aimed at it.” Id. at 61. This is a very helpful point for trial attorneys who will be seeking to apply broadly written collateral source statutes against subrogation claims being asserted by ERISA plans.

The Wurtz court reasoned that the second prong was satisfied by determining that the question of does the statute “substantially affect[] risk pooling” to be an analysis of the impact when the law applies, rather than a question of to how large a group does the statute apply.

“[T]he test is not whether the law substantially affects the whole insurance market—the test is whether the law substantially affects how risk is shared when it applies. For example, even though only a subset of insureds suffer from mental illness, the Supreme Court has held that a law requiring minimum mental health care benefits regulates insurance and is thus saved from preemption. Metro. Life Ins. Co. v. Massachusetts, 471 U.S. 724, 743 (1985).”

Id. at 11

This is the same analysis that First Circuit of Florida undertook when it reached its opinion in 2010. (Coleman v. Blue Cross and Blue Shield of Alabama, No. 1D10-1366, December 8, 2010). The ERISA plan in Wurtz was a fully insured plan, which means once N.Y. Gen. Oblig. Law § 5‐335 was “saved” it applied to the plan. The ability to use the Wurtz rational against self-funded ERISA plan’s, especially in states like Florida, may prove a difficult challenge.

Self-funded ERISA plan’s enjoy unparalleled recovery rights in large part due to the “deemer” clause of 29 U.S. Code § 1144 (b(2)(b). Self-funded ERISA plans are not “deemed” to be insurance and thus even “saved” insurance statutes do not bind them.

“[No self-funded] employee benefit plan … shall be deemed to be an insurance company … or to be engaged in the business of insurance … for purposes of any law of any State purporting to regulate insurance companies, insurance contracts…” Id.

Thus, most anti-subrogation laws like N.Y. Gen. Oblig. Law § 5‐335 have no ability to regulate self-funded ERISA plans. Even Florida’s 768.76 has been “saved” but found inapplicable to self-funded ERISA plans. (See, Coleman v. Blue Cross and Blue Shield of Alabama, No. 1D10-1366, December 8, 2010). Despite the fact that Florida’s collateral source statute applies to a wide range of parties it does not capture self-funded ERISA plans.

The Coleman court explained the three step process for how these self-funded plans escape 768.76 rather succinctly when they wrote:

“State laws directed toward the plans are pre-empted because they relate to an employee benefit plan but are not “saved” because they do not regulate insurance. State laws that directly regulate insurance are “saved” but do not reach self-funded employee benefit plans because the plans may not be deemed to be insurance companies, other insurers, or engaged in the business of insurance for purposes of such state laws” Id.

Despite this reasoning the Coleman court reminds the plaintiff’s bar that insofar as an ERISA plan is covered by insurance, the Plan is bound by state regulations that would apply to their insurance carrier. (See also, FMC Corp. v. Holliday, 798 U.S. 52 (1990). This language, the fact of the remand in Coleman, and the reasoning of Wurtz mandate that the wise plaintiff’s attorney verify the funding status of the ERISA plan in question. Obtaining the Master Plan Document via a proper 29 U.S.C. 1024(b)(4) request is more important than ever.

In practice the plaintiff’s attorney should attempt to have the self-funded ERISA plan realize the application of Wurtz, Coleman, and FMC to them for the portions of their payments that came from an insured plan or were reimbursed by stop-loss coverage. It is always a solid practice for Florida attorneys to send the ERISA plan a 768.76(6) notice. If the plan does not comply with 768.76(7), inform them that the portion of their claim that represents payments from an insured plan or from a self-funded plan reimbursed by stop-loss coverage has been waived under the above rationale. This should also mean that 768.76(8) will cut off the accrual of that portion of their lien at the settlement date. Additionally, if a resolution is not agreed to, an equitable distribution hearing can be requested. However, it is unlikely that self-funded ERISA plans or their recovery vendors will capitulate on this point. Despite their unwillingness to openly agree with this reasoning, it should give them sufficient pause so they will consider a reasonable compromise.

– See more at: file:///Volumes/Design/Source%20Files/Synergy%20Settlement%20Services/Website%20Development/Site%20Backup%20Feb%202015/www.synergysettlements.com/blog/16905/index.html#sthash.SlongRyy.dpuf

Can a Third Party Hold Settlement Funds Until Medicare Issues a Final Demand?

The Northern District of Indiana thinks it is a jury question as to whether or not the third party carrier acted reasonably in holding settlement funds until Medicare’s Final Demand had been issued (Dolgos v. Libery Mutual Ins. Co., 2013 U.S. Dist. 129369 (N.D. Ind. September 4, 2013)). In the subject case, the plaintiff was injured in a slip and fall, retained counsel, and was able to obtain a settlement in the amount of $20,000from the tortfeasor, who was insured by Liberty Mutual. Despite a settlement being reached, and releases executed, Liberty Mutual refused to disburse funds until the Medicare conditional payment issue had been fully resolved. The plaintiff sued Liberty Mutual for breach of the settlement contract claiming this was an unreasonable delay to which Liberty Mutual responded with a motion of summary judgment.

Liberty Mutual argues that despite having executed settlement releases on January 19, 2012, they acted reasonably by not issuing the settlement funds until December 10, 2012.

“Liberty Mutual argues that it acted reasonably in postponing release of the settlement proceeds until after receipt of Medicare’s final determination letter.

…

If the beneficiary receives a primary payment and does not reimburse Medicare within 60 days, the primary payer must reimburse Medicare even though it has already reimbursed the beneficiary or other party. See 42 C.F.R. § 411.24.

…

Liberty Mutual asserts that, if it had paid Lucille Dolgos the agreed upon settlement amount and later learned that Medicare had already paid her, Liberty Mutual would have had to reimburse Medicare the $403.33”

Dolgos v. Libery Mutual Ins. Co., 2013 U.S. Dist. 129369 (N.D. Ind. September 4, 2013)

Though every party to a settlement which involves Medicare conditional payment issues can sympathize with the apprehension of Liberty Mutual, their all or nothing approach appears unreasonable. The plaintiff’s argument is a common sense one:

“whether it was reasonable for Liberty Mutual to withhold all of the $20,000 settlement payment pending confirmation from Medicare rather than paying most of the settlement payment and withholding only the $403.33 at issue”

Dolgos v. Libery Mutual Ins. Co., 2013 U.S. Dist. 129369 (N.D. Ind. September 4, 2013) (emphasis added)

The Court agreed that the question of whether the actions of Liberty Mutual were reasonable is one of material fact and should be decided by a jury. While all parties, including the plaintiff’s attorney himself, understand that liability to repay Medicare attaches to everyone who is involved in the personal injury settlement, that does not mean that the entire settlement can be or should be withheld until the Medicare conditional payment issue is fully resolved. This is an excellent ruling for the plaintiff’s bar to use in confronting what is an increasingly common practice of insurance carriers.

BLOGS

READY TO SCHEDULE A CONSULTATION?

The Synergy team will work diligently to ensure your case gets the attention it deserves. Contact one of our legal experts and get a professional review of your case today.